Source: Seeking Alpha

August 30th, 2012

I last wrote on Vale (VALE) in early July this year, and since then, the company's price has fallen further by 22%, and is now trading at around $16 per share. This rapid price decline has seen a number of market pundits emerge, declaring that with a price-to-earnings ratio of around six and a dividend yield of 7%, the company is now a stunning value investment opportunity. In my previous article, I came

to the conclusion that Vale was a particularly volatile stock with an

unpredictable future because of the significant uncertainty surrounding

the company and its operations. This includes the ongoing uncertainty

surrounding iron ore prices and the direction of the Chinese economy, along with the growing political risk. At this time, none of these risks have subsided, and in some cases have only magnified, increasing the difficulty in predicting the direction of the stock.

Financial performance continues to be poor

While the company's second quarter 2012 revenue

increased in comparison to the first quarter (QoQ) by 7% to $12

billion, net income fell by 30% to $2.7 billion. The company's EBITDA,

which I believe is a better measure for comparing financial performance,

increased QoQ by 3% to $5.1 billion.

But in comparison to the

same period for 2011 (YoY), Vale's second quarter 2012 performance was

extremely poor. Reported revenue was down by 21%, EBITDA was down by 44%

and net income declined by 58%. It is this considerable downturn in financial performance that has caused the share price to plunge 40% over the last year.

The

company's cost-of-goods-sold (COGS) for the second quarter 2012 also

increased QoQ by 5.7% to $6 billion as a result of increased production.

This gives Vale a COGS to revenue ratio of almost 50%, which is an

indicator of efficiency, remains unchanged from the previous quarter. This indicates that, despite increasing production, Vale has been able to continue operating efficiently -- and more efficiently than either Rio Tinto (RIO) or BHP Billiton (BHP), with COGS to revenue ratios for the second quarter 2012 of 67% and 69%, respectively.

These numbers, along with the many positive comments coming from the Vale camp regarding the future of iron ore prices and company performance, leave

a particularly positive view of the company. But there are many

additional factors that investors need to take into account before

taking the plunge and investing in Vale at this time.

Despite attempts to diversify production, iron ore is the key profit driver

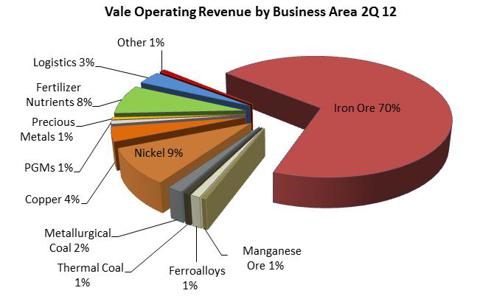

The majority of Vale's revenues are derived from iron ore products, which in the second quarter, accounted for 70% of all revenue. This was then followed by nickel, fertilizer nutrients such as potash and phosphates, copper, and then logistics, as the chart below shows.

(click images to enlarge)

Source data: Vale US GAAP 2Q12 Performance

While

Vale has sought to diversify its revenues, iron ore is the key driver

of profitability. Furthermore, these efforts at diversification have not

been particularly successful, with Vale's choices of

producing base metals and fertilizer nutrients also seeing their prices

fall, along with other commodities because of the current global

headwinds.

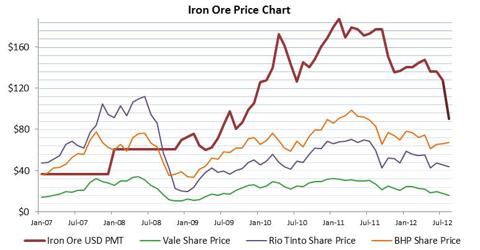

This dependence on iron ore as the key revenue

generator means there is obviously a significant correlation between the

iron ore price and Vale's share price, as shown in the chart below.

Source data: Index Mundi, Bloomberg, Yahoo Finance, Fidelity

However, interestingly, the

chart indicates that both BHP's and Rio's share prices have a greater

correlation to the price of iron ore than Vale's. This would indicate

that there are other factors holding back Vale's share price that are

unrelated to iron ore price.

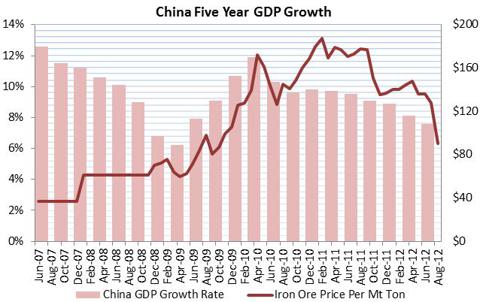

The iron ore price is deteriorating rapidly

Over the last eight months, the price of iron ore has deteriorated rapidly, and is now at $90 per metric ton (pmt). This is the lowest price for iron ore seen since October 2009, and

represents a 52% fall from iron ore's peak price of $187.18 pmt in

February 2011, as well as a 36% decline for the year-to-date.

The primary drivers for the plunge in iron ore prices is the government-induced soft landing in China, which has seen Chinese economic activity, and therefore demand, for basic materials slow significantly. For the second quarter 2012, China's

economy expanded by 7.6%, which is its slowest rate since the first

quarter of 2009. It is also predicted that there won't be a significant

uptick in economic activity for the third quarter and that full year

economic growth will be around 8.2%.

Source data: Index Mundi, Bloomberg, National Bureau of Statistics of China

This chart also illustrates the correlation between the rate of Chinese economic growth and the iron ore price. This correlation, along with that between the iron ore price and Vale's share price, clearly indicates that Chinese economic growth is key to Vale's financial performance and value.

Chinese economic outlook is uncertain

The long-term outlook for China is positive, with

the country still in the midst of growing its economy, building

infrastructure and industrializing. This process brings with it a

tremendous demand for basic materials, ranging from those

required to build the industrial infrastructure of a growing

manufacturing base to constructing the housing and commercial

infrastructure for a rapidly urbanizing population and expanding

business sector.

But for the short to medium-term, the outlook is

not so bright. This can be attributed to a number of factors, but key

are the global headwinds caused by Europe's financial crisis and ensuing

austerity measures, which have caused the demand for a wide range of

goods manufactured in China to fall. In conjunction with this is the

Chinese government-induced soft landing, which has been used to rein in a

growing property bubble and spiraling inflation.

The latest

Chinese manufacturing and non-manufacturing PMI data was also not

particularly positive for investors. For July 2012, the manufacturing PMI came in at 50.1 points, which is its lowest point since November 2011. The non-manufacturing PMI

came in at 55.6 points, which was a 1.1 point decrease from June. But

on a positive note, both PMIs are still above the all-critical 50 point

threshold, which differentiates between whether economic activity is

expanding or contracting, with 50% representing now change.

Furthermore,

with European headwinds having a greater than expected impact on the

Chinese economy, leading it to slow more than planned, it is likely that

the Chinese government will consider easing

economic policy in an effort to head-off a broader economic slowdown.

This will be primarily driven by policies aimed at promoting domestic

demand as a means of buoying industrial production. Normally any

measures that indicate increased Chinese economic growth would be a

strong positive indicator for commodities stocks. This leaves a far more

positive impression of the outlook for China, and one would think, the

demand for basic materials like iron ore.

Demand for iron ore will remain low for some time

Despite

this positive long-term outlook, however, there are two factors that

will affect the demand for iron ore and other basic materials in the

short to medium-term. The first is that the Chinese government is

determined to switch from an export driven economy, particularly in

light of the impact of the European crisis on China, to one that is

driven by domestic consumption and demand. Obviously, this will cause

the demand for basic materials to slow over the long-term, as

discretionary consumer industries and financial services grow, and

manufacturing for export growth becomes less important.

However,

the transition to an economy driven by domestic consumption requires a

far higher degree of development, and typically the transition from

being upper middle income to a high income economy. China is only

starting out on this path and to complete this transition, will require a

considerable amount of further development.

The second, and

probably the most significant, factor affecting the short-term demand

and price for iron ore are the large stock piles if it and other basic

materials currently held in China. At the end of June 2012, it was

estimated that iron ore stock piles

almost totaled 100 million tons, and that other raw materials stock

piles were continuing to grow. Until these massive stock piles have been

reduced, it would not be profitable for manufacturers to continue

importing raw materials at the pace they have been in the past.

The

consensus long-term forecast price for iron ore is in the $75 to $80

pmt range, and I certainly believe this is where the price will move

given the muted demand and high iron ore inventories in China. This is

significantly lower than the average second quarter 2012 iron ore price

of $103 pmt Vale received, and the $109 pmt received in the first

quarter. For the next two quarters, it is likely that the iron ore price

will be moving around the $90 pmt.

Other immediate matters and risks affecting Vale

Vale

is also exposed to a considerable amount of political risk, which is

leaving the company engulfed in uncertainty, and which is certainly

affecting its pricing. These issues are rarely mentioned by the pundits

claiming that Vale represents value at its current price, however, they

are having a material effect on the company's performance and outlook.

The

first issue is a taxation dispute arising from a Brazilian government

claim for an additional $15 billion tax on profits from Vale's foreign

subsidiaries. Already to date, Vale has contested this claim on the

basis that it constitutes double taxation and is, therefore, a breach of

the Brazilian constitution. The lower court, which originally heard the

matter, found in favor of the Brazilian government and this decision

was upheld on appeal to the 2nd Federal Region Tribunal. The matter is

now before the Brazilian Federal Supreme Court for deliberation, and a

decision has yet to be handed down.

While Vale's CEO Murilo Ferreira is confident

of winning the case, the lack of transparency in the Brazilian legal

system and the government's willingness to overtly interfere in the

economy makes it difficult to determine the outcome with any certainty.

It also appears unlikely that the Supreme Court will find in favor of

Vale when two lesser courts have made rulings against the company in

favor of the government's claim.

If Vale loses the appeal and has

to pay the additional taxes, the company's capital expenditure program

will effectively be crippled. This will prevent the company from

diversifying its revenues outside of iron ore and continuing to invest

in a range of projects. These projects include the Belo Monte

hydroelectric power plant, the Pacific Hydro wind energy joint venture

and the company's expansion into Canadian potash, which has already been postponed.

Vale is also embroiled in a royalties dispute

with the Brazilian government. The government is claiming that the

company owes an additional $2 billion in royalties. It is likely that

this matter will be settled over the next month, and it has been

speculated that, as part of the settlement, Vale will pay the full

amount claimed by the government.

Both of these matters leave me

feeling particularly uneasy about investing in the company in an

environment where the price of its principal product, iron ore, is

falling precipitously and can't be determined with any degree of

certainty.

Valuing Vale

Many of the pundits

who are calling Vale a value opportunity are doing so on the basis that

it is trading with a TTM P/E ratio of 6 and has a TTM dividend yield of

7%. These ratios in comparison to many other stocks make Vale look like

a bargain that is too good to miss. But many of these ratios are based

on historical indicators and data, which means they do not take into

account the less than optimistic future outlook for iron ore prices.

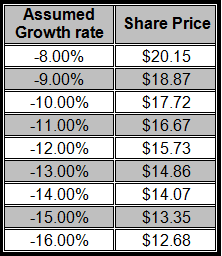

For

this reason, I have attempted to determine a valuation range for Vale

using a free cash flow to equity valuation based on the following

assumptions:

- The iron ore price is calculated at $90 pmt, which is a 15% decrease from the average price received by Vale over the first half of 2012.

- Expenses remain steady, with the COGS to revenue ratio remaining at around 50%.

- Capital expenditure remains unchanged, but I would expect this to drop if the price of iron continues to move downward.

- The assumed rate of growth is negative 12% based on the price of iron or for the remainder of 2012.

Based

on these assumptions, I arrived at a short-term indicative price of

around $16, but there are a wide range of factors and assumptions that

can change this. I have allowed for a range of different assumed growth

rates in the table below, and set out the corresponding prices per share

that were calculated:

It

is important to stress that these are indicative prices only. When

calculating these valuations, I have only taken into account a limited

range of assumptions regarding Vale's operating environment. Investors

should recognize that there is a significant range of factors and

combinations of these factors that have the potential to negatively

impact Vale's share price.

Bottom line

The

outlook for Vale over the short-term is particularly uncertain, and at

this time, the medium and long-term outlooks are not particularly

positive. At current iron ore prices, I would expect to see the company

cut its shareholder remuneration, with the first payments to be cut

being the interest on shareholders' equity (ISE). It would be impossible

for Vale to suspend its dividend payment completely unless it reports a

net loss, because Brazilian companies are legally compelled to payout

25% of net profit to shareholders.

Furthermore, it is clear that

Vale is still surrounded by significant uncertainty, which makes it

impossible to state that it represents a value at its current price,

nor is it possible to pick the stock's bottom. This is primarily due to

not only the uncertainty surrounding the iron ore price, but also the

financial risk associated with the tax and royalties disputes, which

total $17 billion.

For these reasons, I am very hesitant to make

any positive statements regarding the outlook for Vale, particularly

with so many unknowns that have a high potential financial impact on the

company yet to be played out. In the wrong set of circumstances,

including a significant dividend cut, it is feasible that Vale's share

price will move well below its current price. For all of these reasons,

it would be prudent for investors to take a wait and see approach, while

monitoring the leading indicators of Chinese economic activity and iron

ore demand, as well as the outcomes of the tax and royalty disputes.